Sensex Rises 223 Points to 81,207 | Kalyan Jewellers, Indian Bank, Tata Steel, Divi’s Lab Among Top F&O Gainers

📊 Market Recap: Sensex Extends Gains

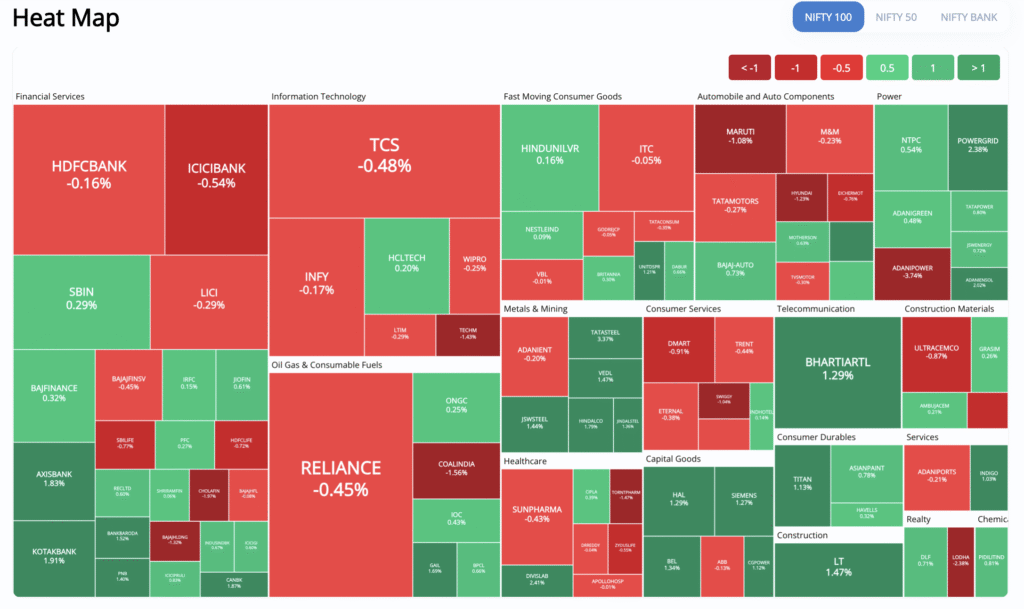

Indian equities ended the day in green as Sensex advanced 223 points to close at 81,207. Gains were led by banking, metals, pharma, and infra stocks, supported by firm global cues and steady buying in large-cap counters.

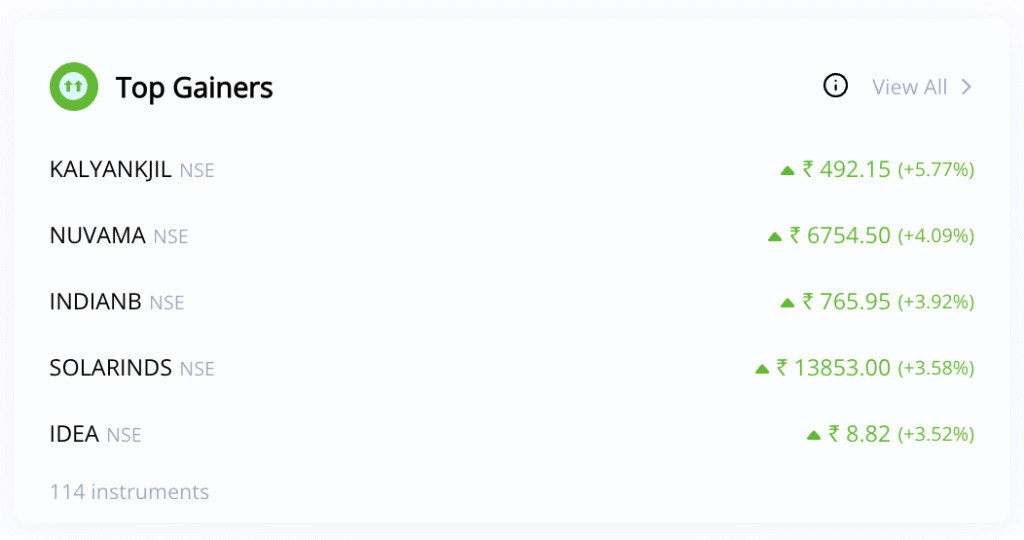

🚀 Top F&O Gainers Today

Symbol | Sector | Key Highlights |

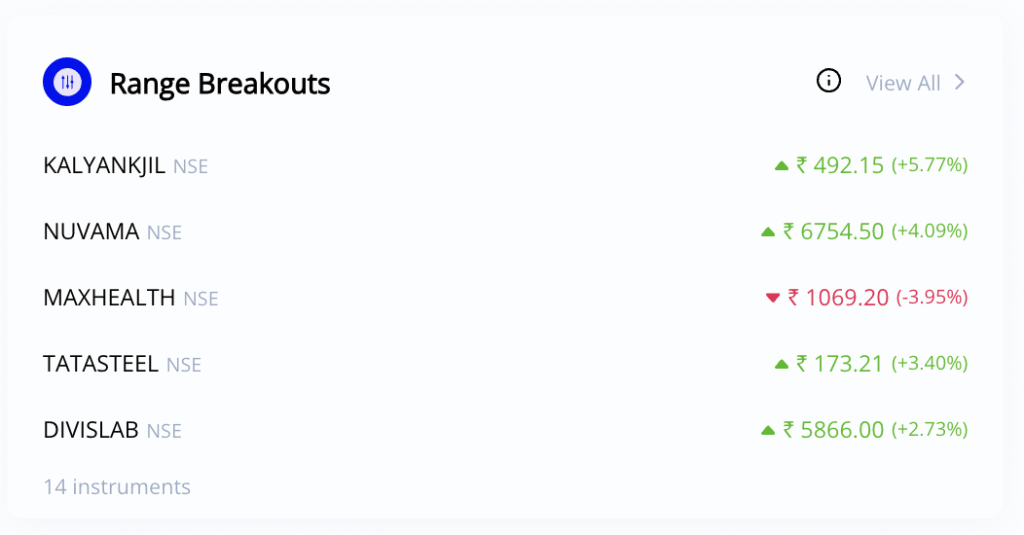

Kalyan Jewellers (KALYANKJIL) | Retail | Surged on festive demand optimism. |

Indian Bank (INDIANB) | Banking | Rose on strong credit growth visibility. |

Vodafone Idea (IDEA) | Telecom | Continued rally on tariff hike hopes. |

Nuvama (NUVAMA) | Financials | Gained on healthy inflows and sector sentiment. |

Solar Industries (SOLARINDS) | Defense/Chemicals | Jumped on strong export orders. |

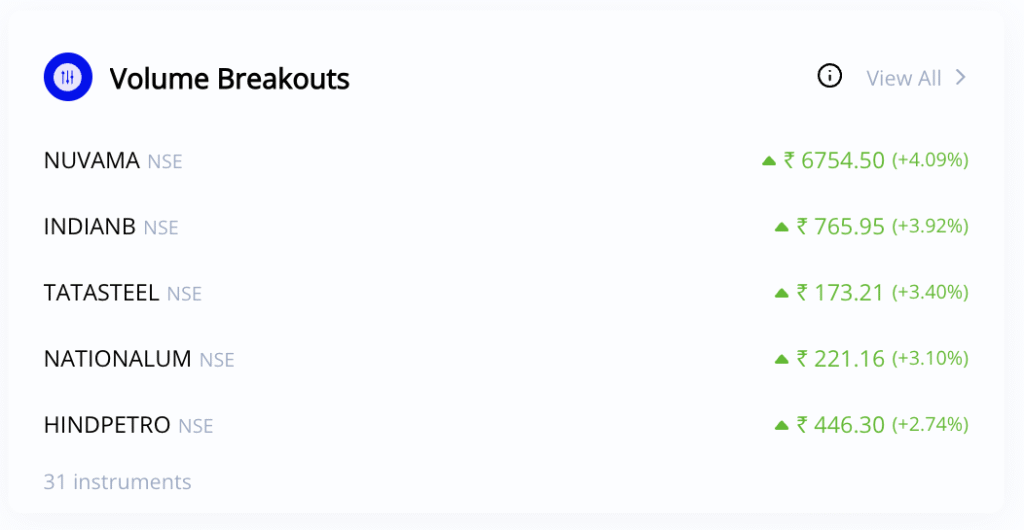

Tata Steel (TATASTEEL) | Metals | Gained on rising global steel prices. |

HFCL | Telecom/Infra | Rose on new 5G infrastructure deals. |

NBCC | Infra | Advanced on robust government project pipeline. |

National Aluminium (NATIONALUM) | Metals | Gained with positive commodity outlook. |

Power Grid (POWERGRID) | Utilities | Rose on strong operational performance. |

SBI Card (SBICARD) | Financials | Gained on festive spending boost. |

Oracle Financial (OFSS) | IT | Advanced on strong global tech demand. |

Hindustan Petroleum (HINDPETRO) | Oil & Gas | Rose with refining margin optimism. |

Divi’s Laboratories (DIVISLAB) | Pharma | Gained on improved demand outlook. |

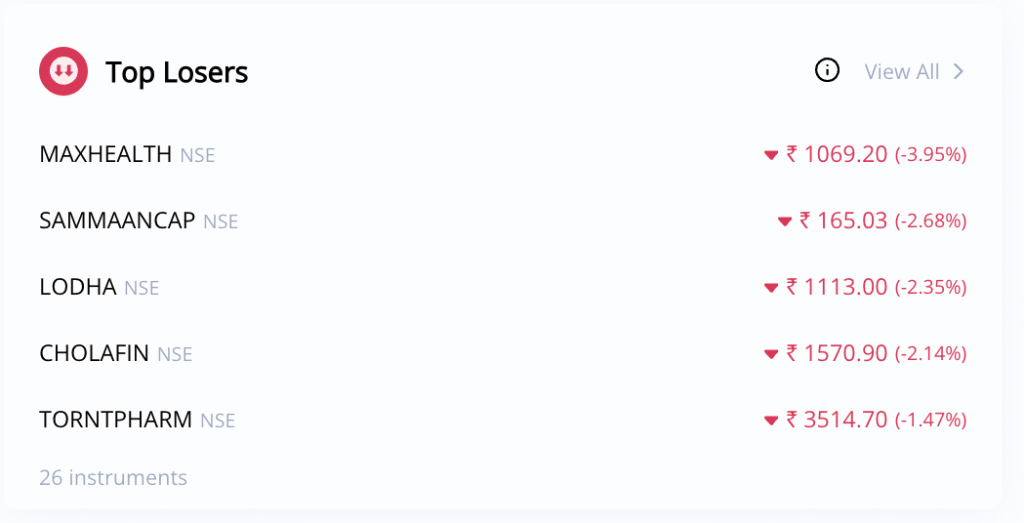

🔑 Key Theme: Rally was broad-based, with participation from banking, metals, oil & gas, pharma, and retail stocks, reflecting strong domestic momentum.

📈 Sensex Closing Highlights

- Sensex closed at 81,207, up by 223 points.

- Banking, metals, and pharma stocks drove the gains.

- Broader market sentiment remained positive with PSU banks and infra in focus.

📝 Conclusion: Market Outlook

The market continues to display resilience with support from banking and metal counters. Going ahead, investors should watch for cues from US inflation data, crude oil movement, and domestic macroeconomic updates. A stock-specific approach focusing on banks, infra, and select pharma names could deliver opportunities in the near term.

Add a comment Cancel reply

Categories

- 3% Rule with AI (1)

- Alcoholic Beverages (1)

- Building Products – Pipes (1)

- Cement (2)

- Commodities Trading (1)

- Communication Services (1)

- Consumer Finance (3)

- Consumer Staples (2)

- Finance (1)

- FNO Calculator (3)

- Gas Distribution (1)

- Heavy Electrical Equipments (1)

- Heavy Machinery (1)

- Home Financing (1)

- How to Use FNO (3)

- Industrial Machinery (1)

- Investment (1)

- Investment Banking & Brokerage (2)

- Iron & Steel (1)

- IT Services & Consulting (5)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (3)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (2)

- Renewable Energy (1)

- Retail – Apparel (1)

- Shipbuilding (1)

- Specialty Chemicals (2)

- Stationery (1)

- Stock Market News (23)

- Uncategorized (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.

Popular Tags

Related posts

🔥 Sensex Rallies 398 Points to 82,172 | PGEL, MCX & BSE Shine Among Top F&O Gainers

Fortis, Nykaa, Paytm Lead Market Comeback | Sensex Ends 582 Points Higher

Sensex Surges 715 Points to 80,983 | Shriram Finance, Tata Motors, Nykaa Among Top F&O Gainers