Mixed Market Close: Banks & Autos Gain, IT & Realty Stocks Slide | Sensex Down 57 to 82,102

📊 Market Recap: Sensex Ends Slightly Lower at 82,102 (-57 Points)

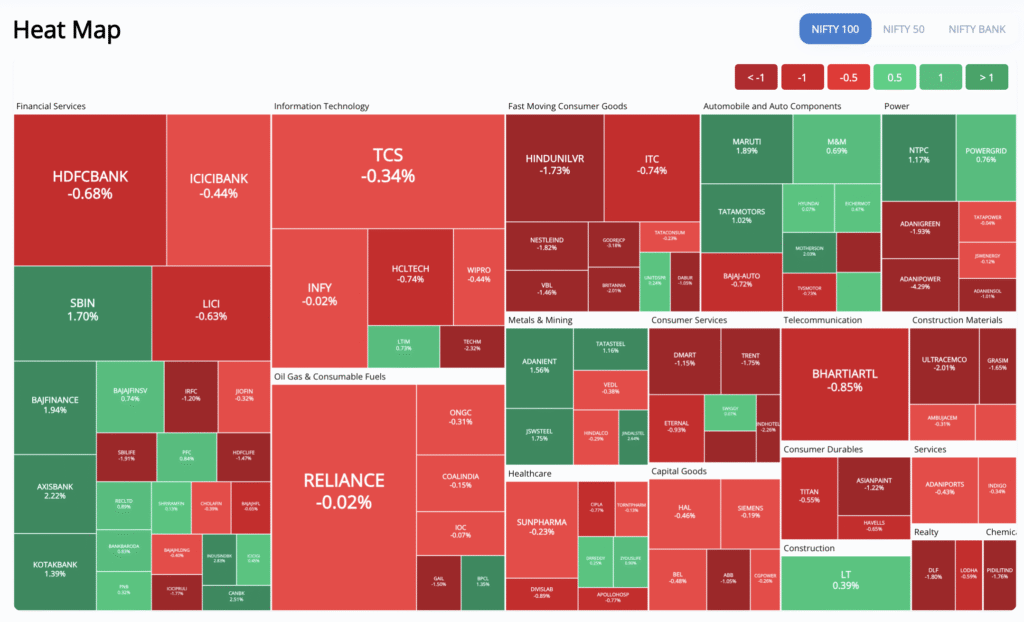

The Indian stock market saw a volatile session, with gains in banking, auto, and metal stocks offset by selling in IT, real estate, and NBFC counters. The Sensex slipped 57 points to close at 82,102, reflecting a mixed sentiment ahead of key macroeconomic cues.

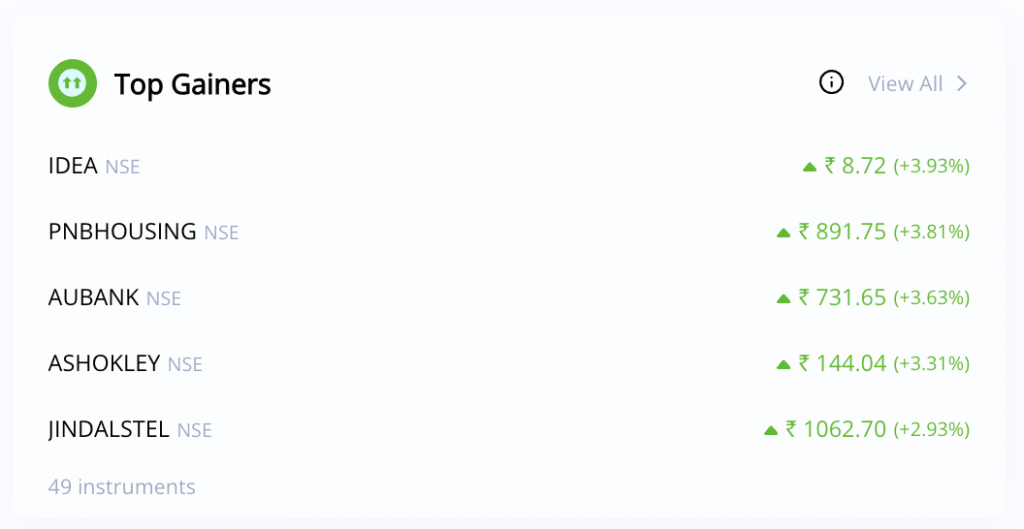

🚀 Today’s Top F&O Gainers

| Symbol | Sector | Key Highlights |

| IAU Bank (IAUBANK) | Banking | Jumped on strong credit growth and retail lending push. |

| PNB Housing (PNBHOUSING) | Housing Finance | Gained on steady loan book expansion and housing demand. |

| Ashok Leyland (ASHOKLEY) | Auto | Advanced on strong commercial vehicle sales outlook. |

| Jindal Steel (JINDALSTEL) | Metals | Rose on rising steel prices and infrastructure demand. |

| IndusInd Bank (INDUSINDBK) | Banking | Moved higher with strong loan growth and healthy asset quality. |

| Hindustan Petroleum (HINDPETRO) | Oil & Gas | Gained on favorable crude oil price movements. |

| Canara Bank (CANBK) | Banking | Continued momentum in PSU banks on credit expansion. |

| Axis Bank (AXISBANK) | Private Bank | Rose on strong Q2 outlook and stable margins. |

| Kaynes Technology (KAYNES) | Electronics/Tech | Rallied on robust order pipeline in semiconductors. |

| Bajaj Finance (BAJFINANCE) | NBFC | Gained on positive AUM growth and retail finance strength. |

| Motherson (MOTHERSON) | Auto Components | Rose on strong global demand in auto sector. |

| JSW Steel (JSWSTEEL) | Metals | Advanced on steel demand recovery and export opportunities. |

| NMDC | Mining | Gained on higher iron ore prices and production growth. |

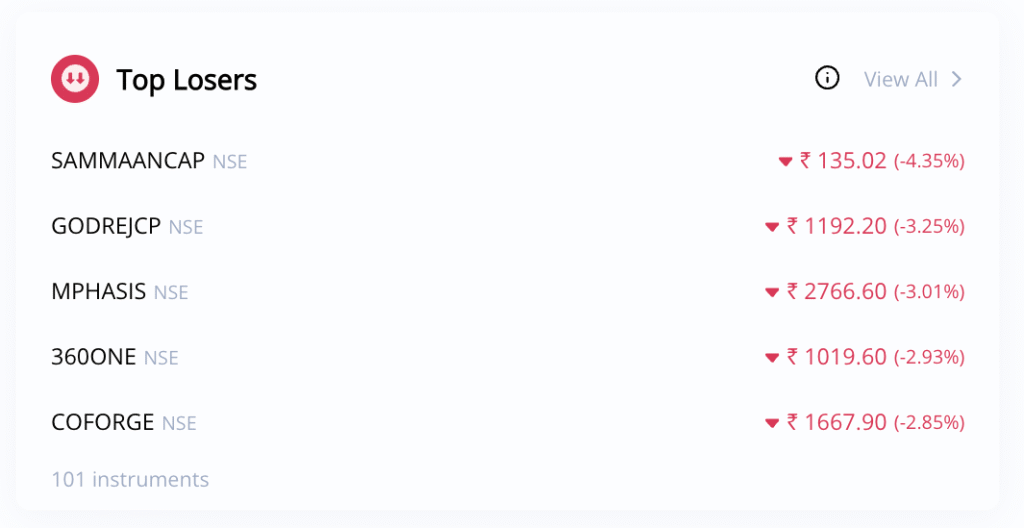

📉 Today’s Top F&O Losers

| Symbol | Sector | Key Highlights |

| Sammaan Capital (SAMMAANCAP) | Financials | Declined after recent strong rally; profit booking seen. |

| Godrej Consumer (GODREJCP) | FMCG | Fell on weak demand outlook in domestic consumption. |

| 360 One (360ONE) | Financials | Dropped amid selling pressure in NBFC space. |

| Coforge (COFORGE) | IT Services | Declined on weak global tech spending outlook. |

| Mphasis (MPHASIS) | IT Services | Dropped on continued concerns in outsourcing demand. |

| IREDA | Renewable Finance | Witnessed correction after recent sharp gains. |

| Tech Mahindra (TECHM) | IT Services | Slipped on muted earnings expectations. |

| Indian Hotels (INDHOTEL) | Hospitality | Declined on profit booking after recent highs. |

| Trent (TRENT) | Retail | Corrected despite strong retail sector growth. |

| Bharat Dynamics (BDL) | Defense | Fell on profit-taking in defense stocks. |

| Delhivery (DELHIVERY) | Logistics | Dropped on concerns around margin pressures. |

| SBI Life (SBILIFE) | Insurance | Declined on sectoral weakness in insurance stocks. |

| HUDCO | Housing Finance | Slipped after sharp previous sessions rally. |

| Suzlon Energy (SUZLON) | Renewable Energy | Dropped due to profit booking in green energy plays. |

📈 Sensex Closing Highlights

- Sensex slipped 57 points to close at 82,102, reflecting consolidation.

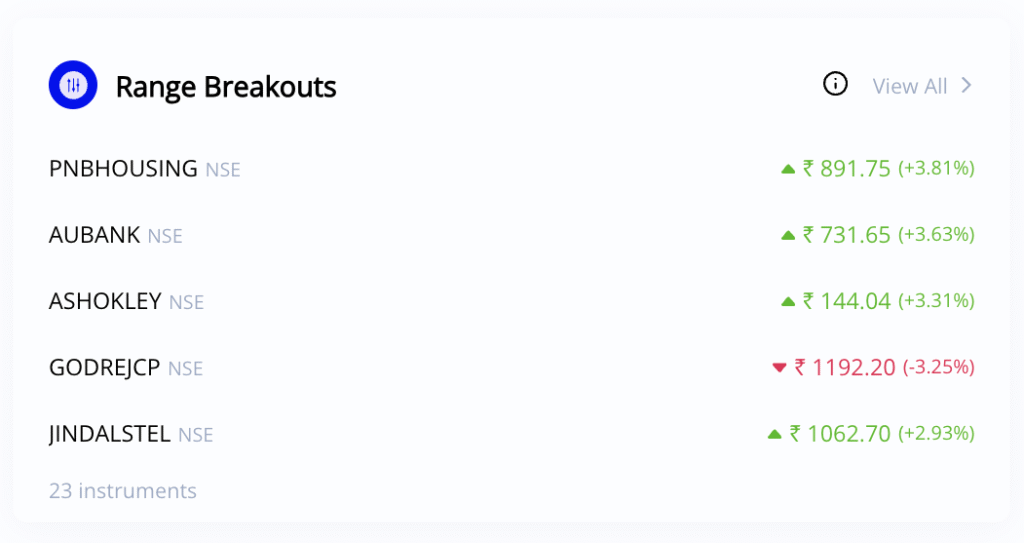

- Banking and auto stocks like IndusInd Bank, Axis Bank, Bajaj Finance, Ashok Leyland, and PNB Housing provided support.

- Metals such as Jindal Steel, JSW Steel, and NMDC extended gains.

- IT and NBFC stocks like Coforge, Mphasis, Tech Mahindra, and Sammaan Capital dragged the market lower.

- The market breadth remained mixed, with selective sectoral strength.

🔎 Conclusion: Market Outlook

The session highlighted sectoral divergence—while banks, autos, and metals rallied, IT, NBFC, and realty stocks weighed on the index. Going forward, market participants will watch global cues and sector earnings for direction.

Investors are advised to stay selective, focusing on growth-driven sectors like banking, auto, and metals, while being cautious in IT and NBFC counters.

Add a comment Cancel reply

Categories

- 3% Rule with AI (1)

- Alcoholic Beverages (1)

- Building Products – Pipes (1)

- Cement (2)

- Commodities Trading (1)

- Communication Services (1)

- Consumer Finance (3)

- Consumer Staples (2)

- Finance (1)

- FNO Calculator (3)

- Gas Distribution (1)

- Heavy Electrical Equipments (1)

- Heavy Machinery (1)

- Home Financing (1)

- How to Use FNO (3)

- Industrial Machinery (1)

- Investment (1)

- Investment Banking & Brokerage (2)

- Iron & Steel (1)

- IT Services & Consulting (5)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (3)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (2)

- Renewable Energy (1)

- Retail – Apparel (1)

- Shipbuilding (1)

- Specialty Chemicals (2)

- Stationery (1)

- Stock Market News (23)

- Uncategorized (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.

Popular Tags

Related posts

🔥 Sensex Rallies 398 Points to 82,172 | PGEL, MCX & BSE Shine Among Top F&O Gainers

Fortis, Nykaa, Paytm Lead Market Comeback | Sensex Ends 582 Points Higher

Sensex Rises 223 Points to 81,207 | Kalyan Jewellers, Indian Bank, Tata Steel, Divi’s Lab Among Top F&O Gainers