Adani Total Gas Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Adani Total Gas Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

Adani Total Gas Ltd (ATGL), a joint venture between the Adani Group and TotalEnergies, is a leading player in India’s city gas distribution (CGD) sector, supplying piped natural gas (PNG) and compressed natural gas (CNG) across domestic, commercial, industrial, and transport sectors. With a market capitalization of ₹74,363.66 crore as of May 2025, ATGL has shown resilience despite market challenges. This blog provides a share price forecast for ATGL for 2025, 2030, 2035, and 2050, leveraging historical Compound Annual Growth Rate (CAGR), recent financial performance, and industry trends to offer a comprehensive outlook.

Financial Overview and Recent Performance

ATGL’s financial performance in FY25 reflects steady growth amid challenges. The company reported a consolidated net profit of ₹654.41 crore for FY25, down 1.96% from ₹667.50 crore in FY24, while revenue from operations grew 11.74% to ₹4,999.86 crore from ₹4,474.74 crore. In Q4 FY25, net profit fell 7.96% year-on-year to ₹154.59 crore, but sales rose 14.94% to ₹1,341.26 crore. EBITDA for Q4 FY25 was ₹274 crore, down 10.16% year-on-year, with margins at 18.6% compared to 23.5% in Q4 FY24. Total sales volume increased 13% to 263 million metric standard cubic meters (MMSCM), with CNG sales up 18% to 177 MMSCM and PNG sales up 5% to 87 MMSCM. The company added 42 new CNG stations, bringing the total to 647, and expanded its steel pipeline network to 13,772 inch-km.

Key financial metrics include a P/E ratio of 101.28, a P/B ratio of 15.68, and a dividend yield of 0.08% (₹0.25 per share). ATGL’s return on equity (ROE) stands at 17.95%, with a debt-to-equity ratio of 0.37, indicating a healthy balance sheet. The company’s historical 5-year CAGR is 25%, but the 3-year return was -74.54%, reflecting volatility. For forecasting, we use a conservative CAGR range of 15–20%, aligning with analyst projections and India’s push for cleaner energy.

Share Price Forecast Methodology

The share price forecast is based on the current price of ₹676.15 (as of May 5, 2025) and a CAGR range of 15–20%. The formula is:

Future Value = Present Value × (1 + CAGR)^n

Where:

- Present Value = ₹676.15

- CAGR = 15% (low estimate) and 20% (high estimate)

- n = Number of years from 2025 to the target year

Analyst reports suggest a 2025 target price of ₹1,200–₹1,500, implying a 77–122% upside. Long-term projections account for ATGL’s expansion in CGD, e-mobility, and biomass, supported by government policies promoting natural gas.

Share Price Forecast

2025: Near-Term Outlook

For 2025, analysts project a target price of ₹1,200–₹1,500, driven by ATGL’s network expansion and rising natural gas demand. Using a 15% CAGR, the share price could reach ₹777, while a 20% CAGR suggests ₹811. The company’s addition of 3,400 EV charging points and 386 new industrial connections in Q4 FY25, along with a “Buy” rating from analysts, supports this optimism. However, higher gas costs and regulatory volatility may temper gains.

2030: Medium-Term Growth

By 2030, a 15% CAGR projects a share price of ₹1,571, while a 20% CAGR yields ₹2,434. ATGL’s focus on biogas, LCNG, and hydrogen, combined with its presence in 33 geographical areas, positions it to capitalize on India’s energy transition. Strategic partnerships with TotalEnergies and a favorable regulatory environment for clean energy are key growth drivers.

2035: Long-Term Potential

For 2035, a 15% CAGR results in a share price of ₹3,177, while a 20% CAGR projects ₹7,716. India’s target to increase natural gas’s share in the energy mix to 15% by 2030, coupled with ATGL’s investments in compressed biogas (CBG) plants, will likely sustain growth. However, competition from GAIL and Indraprastha Gas could pose challenges.

2050: Vision for the Future

By 2050, the share price could reach ₹13,097 at a 15% CAGR or ₹77,317 at a 20% CAGR. These projections assume ATGL maintains its market leadership, expands internationally, and adapts to technological advancements. Risks such as geopolitical tensions and raw material price fluctuations could impact long-term outcomes.

Key Financial Metrics and Investment Considerations

- P/E Ratio: 101.28, indicating a premium valuation due to growth expectations.

- P/B Ratio: 15.68, reflecting market confidence in ATGL’s assets.

- Promoter Holding: 74.8%, with FII (13.06%) and DII (6.23%) stakes, signaling institutional trust.

- ROE: 17.95%, competitive within the sector.

Risks and Challenges

Investors should consider:

- Regulatory Risks: Changes in gas pricing or allocation policies could affect margins.

- Market Volatility: The stock’s 57.7% decline from its all-time high of ₹1,197.95 highlights price fluctuations.

- Competition: Rivals like GAIL and Mahanagar Gas may challenge market share.

Conclusion

Adani Total Gas Ltd is poised for growth, driven by India’s clean energy push and its robust CGD network. Share price forecasts suggest targets of ₹1,200–₹1,500 by 2025, ₹1,571–₹2,434 by 2030, ₹3,177–₹7,716 by 2035, and ₹13,097–₹77,317 by 2050, based on a 15–20% CAGR. While ATGL’s financial health and strategic expansions are promising, investors must weigh regulatory and competitive risks. Consulting a financial advisor is recommended before investing.

Disclaimer: These forecasts are based on historical data and analyst projections and are not guaranteed. Conduct thorough research before making investment decisions.

Add a comment Cancel reply

Categories

- 3% Rule with AI (1)

- Alcoholic Beverages (1)

- Building Products – Pipes (1)

- Cement (2)

- Commodities Trading (1)

- Communication Services (1)

- Consumer Finance (3)

- Consumer Staples (2)

- Finance (1)

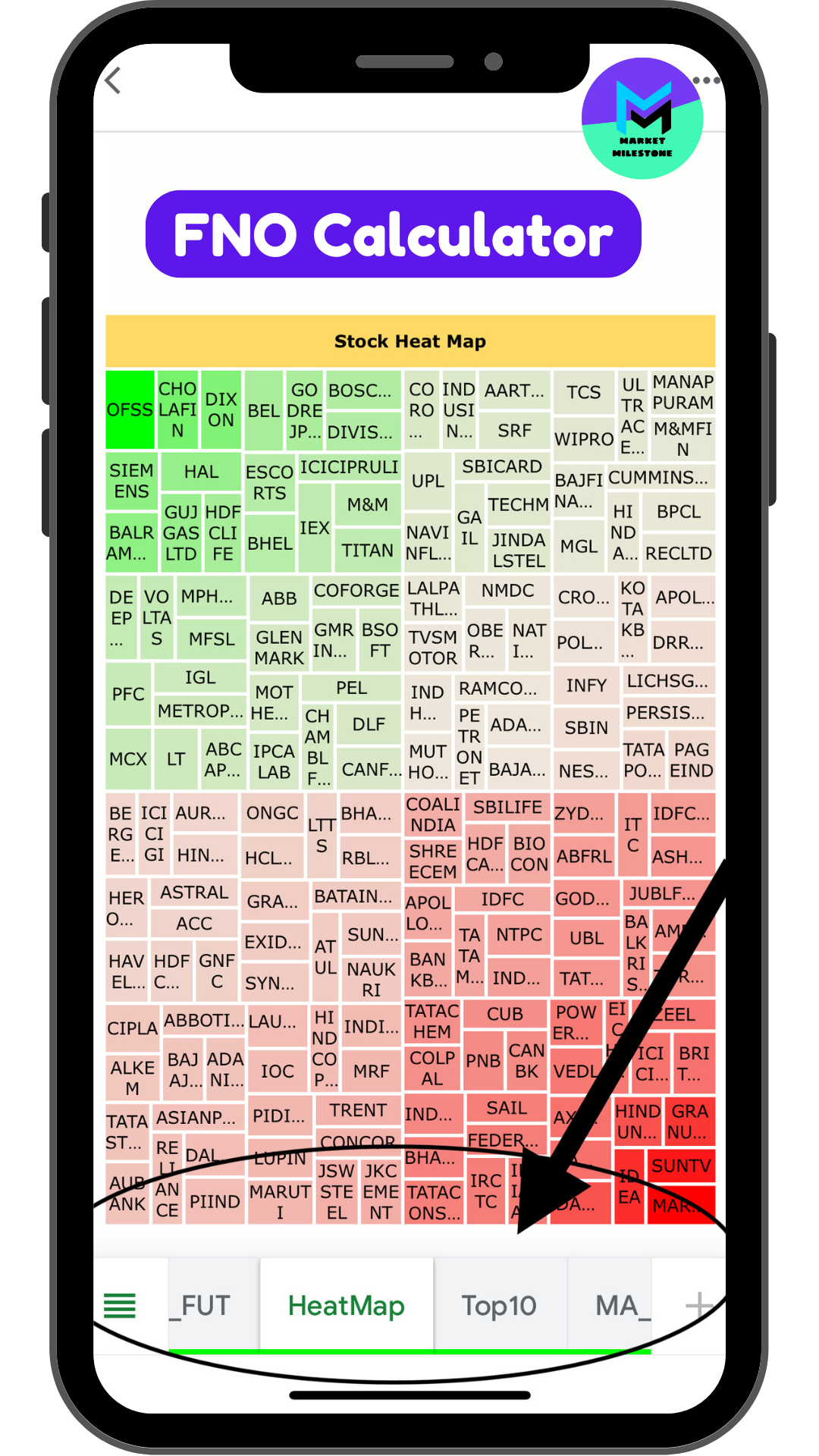

- FNO Calculator (3)

- Gas Distribution (1)

- Heavy Electrical Equipments (1)

- Heavy Machinery (1)

- Home Financing (1)

- How to Use FNO (3)

- Industrial Machinery (1)

- Investment (1)

- Investment Banking & Brokerage (2)

- Iron & Steel (1)

- IT Services & Consulting (5)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (3)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (2)

- Renewable Energy (1)

- Retail – Apparel (1)

- Shipbuilding (1)

- Specialty Chemicals (2)

- Stationery (1)

- Stock Market News (23)

- Uncategorized (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.