Abbott India Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050

Abbott India Ltd Share Price Forecast: 2025, 2030, 2035, and 2050

Abbott India Ltd, a leading pharmaceutical company and subsidiary of Abbott Laboratories, USA, has established itself as a reliable player in India’s healthcare sector. With a market capitalization of ₹64,388 crore as of May 2025 and a reputation for consistent financial performance, Abbott India is a favored choice among investors. This blog provides a share price forecast for Abbott India Ltd for 2025, 2030, 2035, and 2050, utilizing historical Compound Annual Growth Rate (CAGR), recent financial data, and industry trends to project future performance.

Financial Overview and Recent Performance

Abbott India has shown resilient financial growth, particularly in profitability. For Q3 FY25 (ended December 2024), the company reported a 16.01% increase in net profit to ₹360.78 crore, with total income of ₹1,686.03 crore, up 12.95% year-on-year. Annual revenue for FY24 stood at ₹6,097.18 crore, with a net profit of ₹1,201.22 crore. Over the past five years, Abbott India delivered a profit CAGR of 22.0%, though sales growth was modest at 9.72%. The company’s return on equity (ROE) averaged 32.2% over three years, reflecting efficient capital utilization, while a dividend payout ratio of 72.8% underscores its shareholder-friendly approach.

As of May 7, 2025, the share price is ₹30,345, up 17.74% over the past year, with a P/E ratio of 48.00 and a P/B ratio of 18.3, indicating a premium valuation. The company maintains zero borrowings, enhancing financial stability, and promoter holding remains steady at 74.99%, signaling strong parent company confidence.

Historically, Abbott India’s share price CAGR is 17.12% over five years, 13.11% over three years, and 17.78% over one year. For forecasting, we adopt a conservative CAGR range of 12–15%, aligning with analyst projections and the pharmaceutical sector’s growth outlook.

Share Price Forecast Methodology

The share price forecast uses a compounded growth model:

Future Value = Present Value × (1 + CAGR)^n

Where:

- Present Value = ₹30,345 (May 2025)

- CAGR = 12% (low estimate) and 15% (high estimate)

- n = Number of years from 2025 to the target year

Analyst reports, such as those from TradingView, suggest a 12-month target of ₹31,706–₹34,000 for 2025, implying a 4.5–12% upside. This serves as a baseline for short-term projections, extended for long-term estimates.

Share Price Forecast

2025: Near-Term Outlook

For 2025, analysts project a share price of ₹31,706–₹34,000, supported by strong Q3 FY25 results and a “Strong Buy” rating from five analysts. Applying a 12% CAGR, the share price could reach ₹33,986; a 15% CAGR suggests ₹34,896. Growth drivers include Abbott India’s focus on chronic therapies, new product introductions, and a robust distribution network. The board’s approval of a ₹410 dividend per share in 2024 further enhances investor appeal.

2030: Medium-Term Growth

By 2030, a 12% CAGR projects a share price of ₹58,762, while a 15% CAGR yields ₹69,085. India’s pharmaceutical market is expected to grow at a 10–12% CAGR, driven by rising healthcare spending and demand for generics. Abbott India’s zero-debt status and high ROE position it to capitalize on these trends. Strategic leadership changes, such as Kartik Rajendran’s appointment as MD in June 2025, are likely to sustain growth momentum.

2035: Long-Term Potential

For 2035, a 12% CAGR results in a share price of ₹101,580, while a 15% CAGR projects ₹137,523. Abbott India’s investment in R&D and expansion into high-margin segments like diabetes and cardiovascular therapies will drive long-term growth. Government initiatives, such as Ayushman Bharat, and increasing export opportunities to emerging markets are additional tailwinds. However, regulatory changes and pricing pressures may pose challenges.

2050: Vision for the Future

By 2050, the share price could reach ₹524,001 at a 12% CAGR or ₹1,087,632 at a 15% CAGR. These projections assume Abbott India maintains its market leadership, leverages technological advancements in healthcare, and benefits from India’s aging population and rising chronic disease prevalence. Long-term risks include global competition and potential disruptions from biosimilars.

Key Financial Metrics and Investment Considerations

- P/E Ratio: 48.00, reflecting high growth expectations.

- P/B Ratio: 18.3, indicating a premium but justified by strong fundamentals.

- Dividend Yield: 1.36%, with consistent payouts since 1944.

- Shareholding: Promoters (74.99%), FIIs (0.17%), DIIs (8.94%), and public (15.9%), showing balanced ownership.

Industry Context and Growth Drivers

India’s pharmaceutical sector is poised for growth, with a projected market size of $130 billion by 2030, driven by domestic demand and exports. Abbott India’s focus on branded generics, chronic disease management, and digital health solutions aligns with these trends. Government policies promoting local manufacturing (e.g., PLI scheme) further support the company’s expansion plans.

Risks and Challenges

- Regulatory Risks: Stringent pricing controls and compliance costs could impact margins.

- Competition: Rivals like Sun Pharma and Dr. Reddy’s may challenge market share.

- Market Volatility: The stock’s 3-month CAGR of -7.54% highlights short-term fluctuations.

Conclusion

Abbott India Ltd offers a compelling investment opportunity, backed by strong financials, a debt-free balance sheet, and leadership in India’s pharmaceutical market. Share price forecasts indicate potential targets of ₹33,986–₹34,896 by 2025, ₹58,762–₹69,085 by 2030, ₹101,580–₹137,523 by 2035, and ₹524,001–₹1,087,632 by 2050, based on a 12–15% CAGR. Investors should consider the company’s robust fundamentals alongside risks like regulatory pressures and competition. Consulting a financial advisor is recommended before investing.

Disclaimer: These forecasts are based on historical data and analyst projections and are not guaranteed. Investors should conduct thorough research and seek professional advice.

Add a comment Cancel reply

Categories

- 3% Rule with AI (1)

- Alcoholic Beverages (1)

- Building Products – Pipes (1)

- Cement (2)

- Commodities Trading (1)

- Communication Services (1)

- Consumer Finance (3)

- Consumer Staples (2)

- Finance (1)

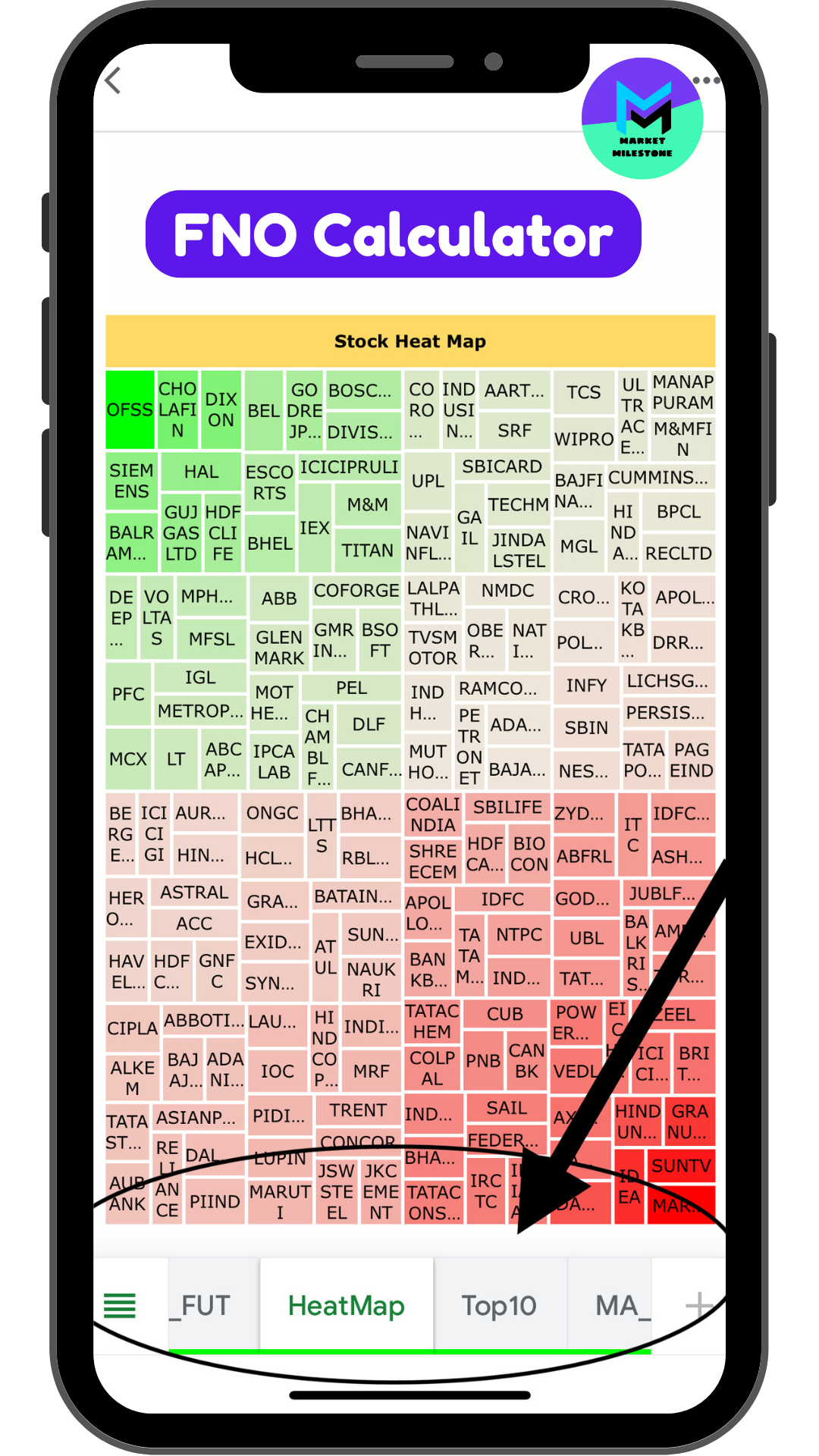

- FNO Calculator (3)

- Gas Distribution (1)

- Heavy Electrical Equipments (1)

- Heavy Machinery (1)

- Home Financing (1)

- How to Use FNO (3)

- Industrial Machinery (1)

- Investment (1)

- Investment Banking & Brokerage (2)

- Iron & Steel (1)

- IT Services & Consulting (5)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (3)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (2)

- Renewable Energy (1)

- Retail – Apparel (1)

- Shipbuilding (1)

- Specialty Chemicals (2)

- Stationery (1)

- Stock Market News (23)

- Uncategorized (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.

Popular Tags

Related posts

Torrent Pharmaceuticals Ltd Share Price Prediction & Financial Analysis: 2025, 2030, 2035, 2050