💹 Sensex Climbs 328 Points to 82,500 | YES Bank, PGEL & Voltas Lead F&O Gainers in a Bullish Session

📈 Market Overview: Bulls Push Sensex to 82,500, Banking & Realty Stocks Shine

Indian equity markets ended the day on a strong note as Sensex surged 328 points to close at 82,500, supported by gains in banking, pharma, and capital goods stocks. The bullish momentum was fueled by positive global cues and strong institutional participation.

The rally was broad-based, with midcap and F&O counters outperforming the broader indices, indicating solid investor confidence across sectors.

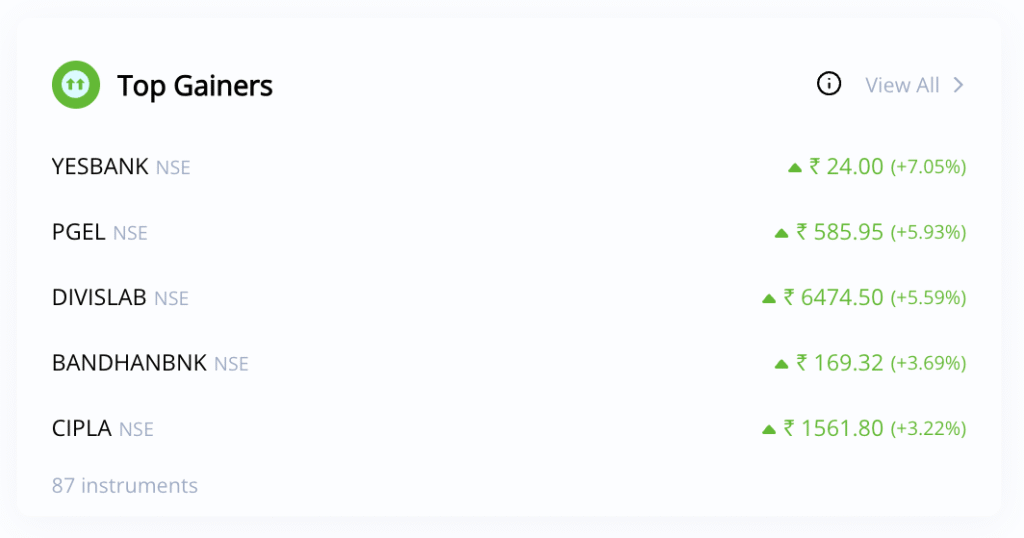

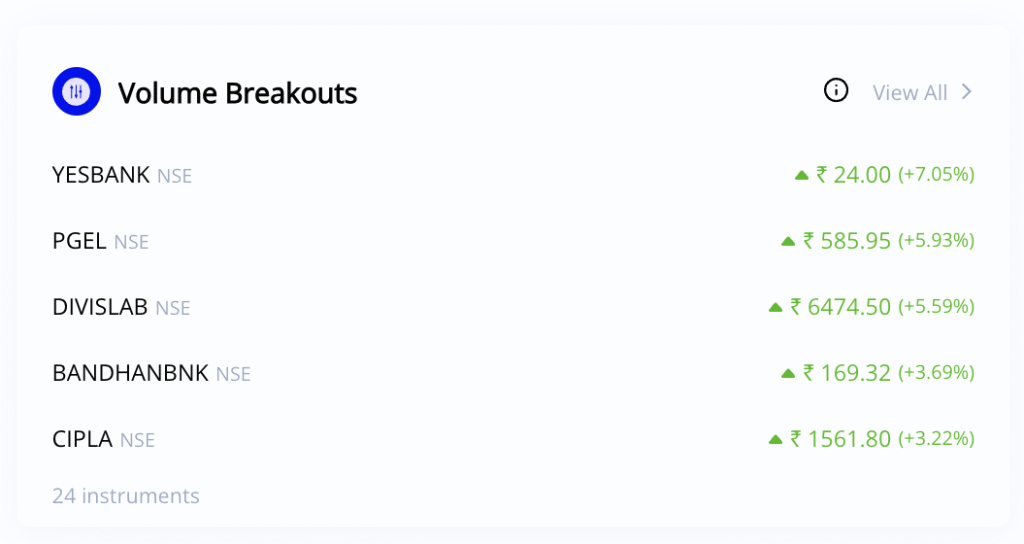

🚀 Top F&O Gainers Today

| Stock | Sector | Reason for Upmove |

| YES Bank | Banking | Stock rallied on high trading volumes and optimism around credit growth. |

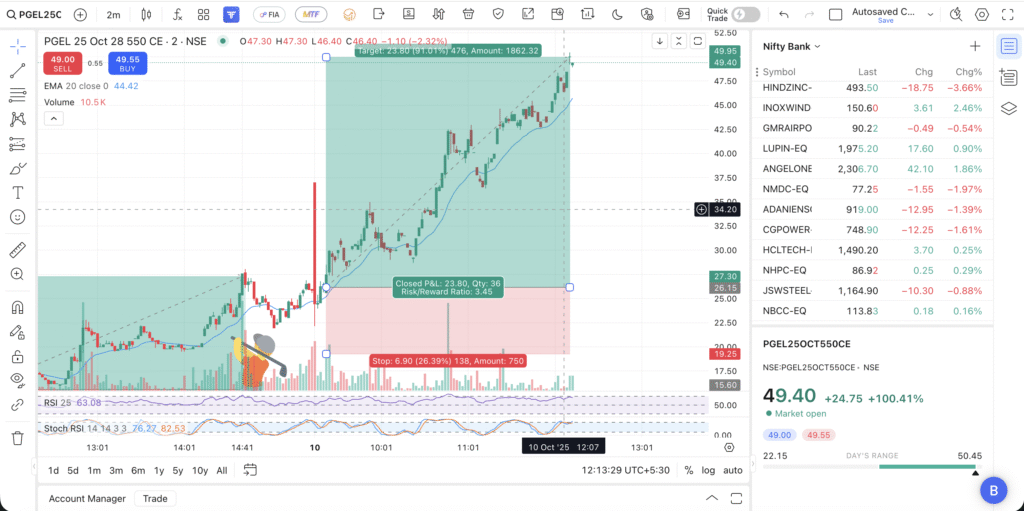

| PG Electroplast (PGEL) | Electronics | Continued its uptrend on robust demand in the consumer durables space. |

| Voltas | Consumer Durables | Gained on festive demand and cooling input costs. |

| HFCL | Telecom & Infra | Rose on strong order wins and 5G infrastructure optimism. |

| Divi’s Laboratories (DIVISLAB) | Pharma | Advanced on strong export demand and margin improvement. |

| Blue Star (BLUESTARCO) | Consumer Goods | Extended rally on healthy sales outlook in cooling appliances. |

| Prestige Estates (PRESTIGE) | Realty | Jumped on strong housing sales data and new launches. |

| Suzlon Energy (SUZLON) | Renewables | Rose on robust project execution and positive sector outlook. |

| PPL Pharma (PPLPHARMA) | Healthcare | Surged after management commentary on expansion plans. |

| BSE Ltd. | Financials | Continued to gain amid high market activity and record daily turnover. |

| Inox Wind (INOXWIND) | Energy | Extended rally following sector tailwinds in renewable energy. |

| Cipla | Pharmaceuticals | Moved higher on upbeat revenue guidance and product approvals. |

| Sona Comstar (SONACOMS) | Auto Components | Gained on strong EV order pipeline and positive outlook. |

| State Bank of India (SBIN) | Banking | Rose after robust loan growth and healthy credit demand reports. |

💹 Sensex Closing Highlights

- 📊 Sensex closed at 82,500, up 328 points

- 🏦 Nifty reclaimed key levels, supported by Banking, Realty, and Pharma stocks

- 💼 Broader market indices also advanced, signaling widespread market participation

- 💵 Investor sentiment improved amid stable global economic indicators

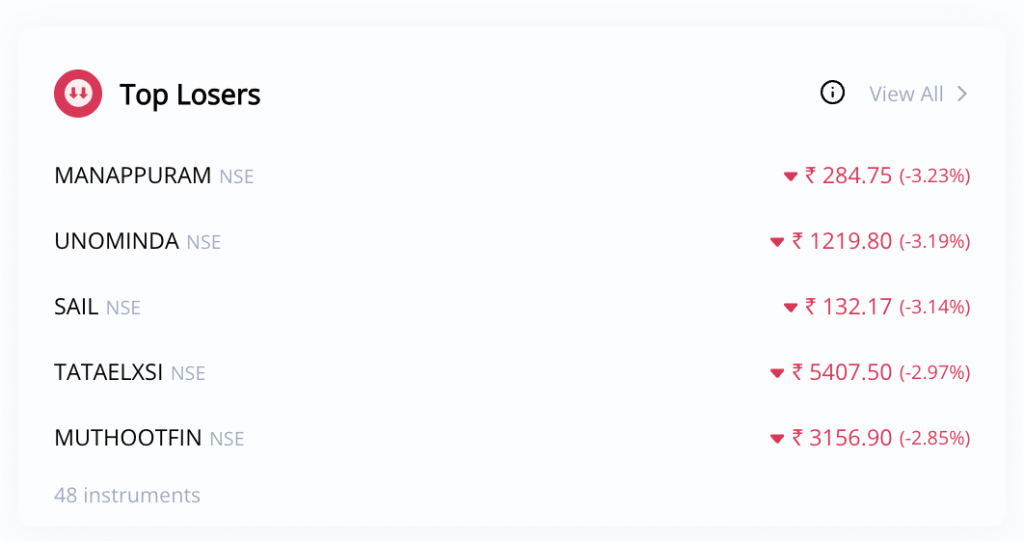

🔍 Market Insights & Sector Analysis

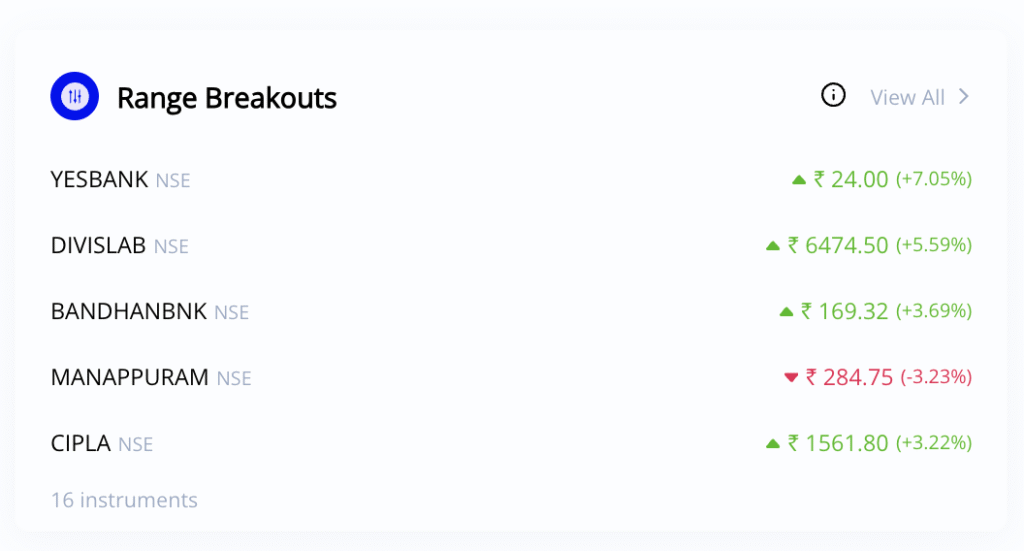

- Banking stocks like YES Bank and SBI led the charge as credit demand continues to rise.

- Pharma sector saw traction with Divi’s Labs and Cipla gaining on strong earnings expectations.

- Consumer goods and electronics stocks such as Voltas, Blue Star, and PGEL rallied on festive season demand.

- Renewables and energy players like Suzlon and Inox Wind benefited from favorable policy tailwinds.

Overall, the market sentiment turned positive as investors bet on India’s economic resilience amid global uncertainty.

🧭 Outlook: Bulls Back in Action

Market experts believe the current rally may continue if global markets remain stable and inflation stays within expected limits.

Focus will remain on banking, pharma, and renewable energy stocks, while investors may look for short-term opportunities in midcap F&O names.

Add a comment Cancel reply

Categories

- 3% Rule with AI (1)

- Alcoholic Beverages (1)

- Building Products – Pipes (1)

- Cement (2)

- Commodities Trading (1)

- Communication Services (1)

- Consumer Finance (3)

- Consumer Staples (2)

- Finance (1)

- FNO Calculator (3)

- Gas Distribution (1)

- Heavy Electrical Equipments (1)

- Heavy Machinery (1)

- Home Financing (1)

- How to Use FNO (3)

- Industrial Machinery (1)

- Investment (1)

- Investment Banking & Brokerage (2)

- Iron & Steel (1)

- IT Services & Consulting (5)

- Market Equity (1)

- Mining – Diversified (1)

- Oil & Gas – Refining & Marketing (1)

- Online Services (1)

- Pharmaceuticals (3)

- Power Infrastructure (1)

- Power Transmission & Distribution (1)

- Precious Metals, Jewellery & Watches (1)

- Private Banks (2)

- Renewable Energy (1)

- Retail – Apparel (1)

- Shipbuilding (1)

- Specialty Chemicals (2)

- Stationery (1)

- Stock Market News (23)

- Uncategorized (1)

Recent Posts

About us

Your Financial Milestone

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.

Popular Tags

Related posts

Fortis, Nykaa, Paytm Lead Market Comeback | Sensex Ends 582 Points Higher

Sensex Rises 223 Points to 81,207 | Kalyan Jewellers, Indian Bank, Tata Steel, Divi’s Lab Among Top F&O Gainers

Sensex Surges 715 Points to 80,983 | Shriram Finance, Tata Motors, Nykaa Among Top F&O Gainers